The Necessary Overview to Getting Bid Bonds for Your Next Project

The Necessary Overview to Getting Bid Bonds for Your Next Project

Blog Article

Essential Steps to Utilize and acquire Bid Bonds Effectively

Navigating the intricacies of bid bonds can substantially impact your success in securing agreements. The real obstacle lies in the precise selection of a reputable provider and the calculated usage of the bid bond to enhance your competitive edge.

Recognizing Bid Bonds

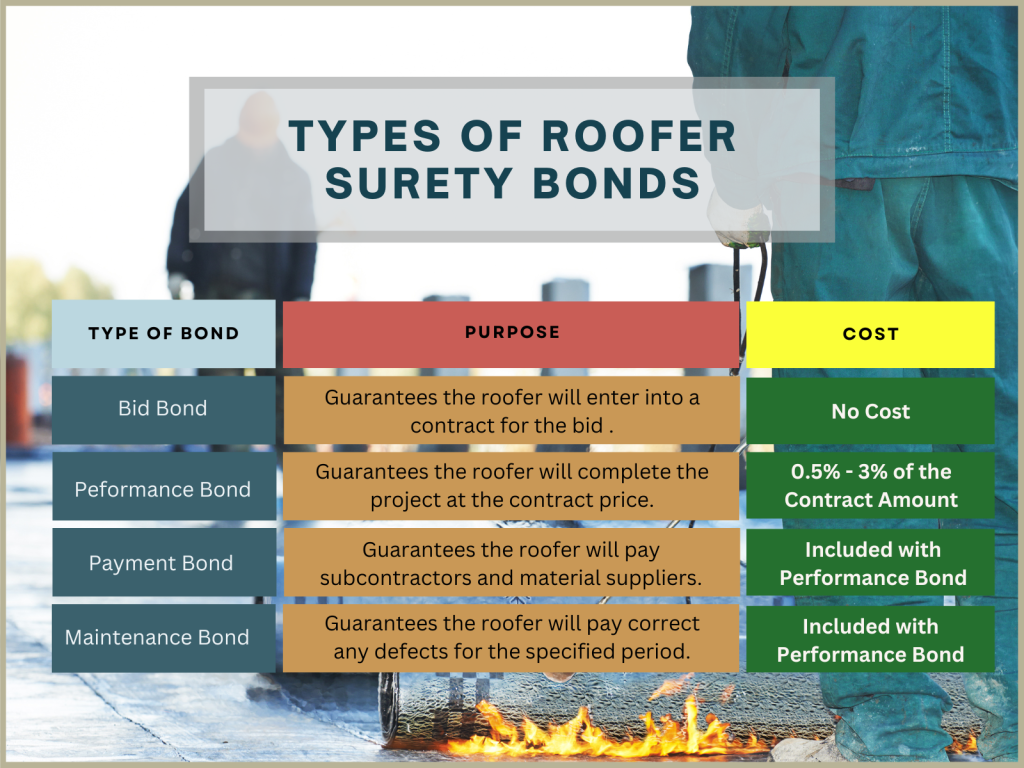

Bid bonds are an essential part in the construction and contracting sector, functioning as an economic guarantee that a prospective buyer intends to become part of the agreement at the proposal rate if granted. Bid Bonds. These bonds mitigate the threat for task proprietors, ensuring that the selected contractor will not only recognize the proposal however likewise secure efficiency and settlement bonds as needed

Fundamentally, a bid bond acts as a safeguard, protecting the task owner against the financial effects of a contractor taking out a bid or falling short to commence the task after selection. Generally released by a surety company, the bond assurances settlement to the owner, often 5-20% of the quote quantity, need to the professional default.

In this context, proposal bonds promote a much more reliable and competitive bidding process environment. Quote bonds play an indispensable role in maintaining the honesty and smooth procedure of the building and construction bidding procedure.

Preparing for the Application

When getting ready for the application of a bid bond, precise company and detailed documentation are critical. An extensive evaluation of the job specifications and bid demands is vital to make sure compliance with all specifications. Beginning by constructing all necessary financial declarations, including annual report, earnings declarations, and cash circulation declarations, to demonstrate your firm's fiscal wellness. These documents must be current and prepared by a qualified accountant to improve integrity.

Following, compile a list of past jobs, particularly those similar in range and dimension, highlighting successful completions and any type of qualifications or accolades got. This portfolio acts as evidence of your business's ability and integrity. In addition, prepare a thorough business plan that outlines your operational strategy, risk administration methods, and any backup intends in position. This strategy supplies an alternative view of your company's approach to task implementation.

Make sure that your organization licenses and registrations are conveniently available and updated. Having actually these documents organized not just speeds up the application procedure but likewise projects an expert photo, instilling self-confidence in potential guaranty companies and task proprietors - Bid Bonds. By methodically preparing these elements, you place your firm positively for successful bid bond applications

Finding a Guaranty Company

In addition, consider the copyright's experience in your particular sector. A surety business aware of your field will better recognize the one-of-a-kind dangers and requirements connected with your tasks. Demand recommendations and check their history of claims and client contentment. It is also advisable to evaluate their financial scores from companies like A.M. Ideal or Criterion & Poor's, guaranteeing they have the monetary stamina to back their bonds.

Engage with numerous service providers to compare prices, terms, and services. An affordable examination will certainly help you protect the very best terms for your proposal bond. Eventually, a detailed vetting process will make sure a trustworthy partnership, fostering confidence in your proposals and future tasks.

Submitting the Application

Sending the application for a quote you can look here bond is an important action that requires thorough attention to information. This process starts by gathering all pertinent paperwork, consisting of financial statements, task specifications, and an in-depth company background. Making certain the accuracy and efficiency of these files is vital, as any kind of discrepancies can cause denials or delays.

When completing the application, it is recommended to double-check all entries for precision. This includes confirming numbers, ensuring proper trademarks, and verifying that all required attachments are included. Any omissions or mistakes can weaken your application, causing unneeded complications.

Leveraging Your Bid Bond

Leveraging your proposal bond properly can substantially enhance your one-upmanship in securing contracts. A bid bond not only demonstrates your financial security yet likewise reassures the project proprietor of your dedication to meeting the agreement terms. By showcasing your quote bond, you can highlight your firm's reliability and trustworthiness, making your proposal stand out among many competitors.

To leverage your proposal bond to its maximum capacity, ensure it is presented as part of an extensive quote bundle. Highlight the stamina of your surety provider, as this mirrors your company's monetary health and wellness and functional ability. In addition, highlighting your performance history of efficiently finished tasks can additionally impart self-confidence in the project proprietor.

Additionally, maintaining close interaction with your surety service provider can assist in better terms in future bonds, thus enhancing your competitive placing. An aggressive approach to managing and restoring your quote bonds can likewise prevent gaps and guarantee continual coverage, which is important for ongoing job procurement efforts.

Conclusion

Successfully obtaining and making use of bid bonds requires detailed this contact form preparation and calculated implementation. By comprehensively arranging key documentation, choosing a trusted guaranty service provider, and submitting a full application, companies can protect the required bid bonds to improve their competitiveness.

Recognizing a reputable surety copyright is a critical step in safeguarding a quote bond. A quote bond not just shows your economic stability however likewise reassures the project owner of click to read your dedication to satisfying the agreement terms. Bid Bonds. By showcasing your bid bond, you can underscore your company's reliability and trustworthiness, making your bid stand out among numerous rivals

To utilize your quote bond to its greatest potential, guarantee it is presented as part of a thorough quote plan. By adequately arranging crucial documents, choosing a trusted surety provider, and submitting a complete application, firms can protect the needed proposal bonds to enhance their competitiveness.

Report this page